Accredited by the Bank of Portugal under registration number 0006974

My service is free of charge for you!

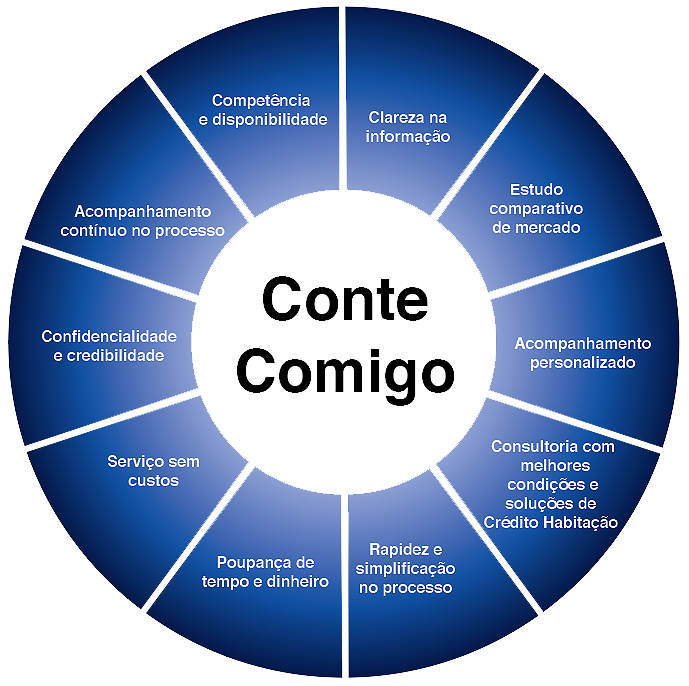

My MISSION is to find the FIT SOLUTION as well as to SIMPLIFY, CLARIFY and ACCOMPANY the various stages of your HOUSING CREDIT process!

With a know-how and professional qualification of more than 20 years in the financial sector in commercial and managerial functions.

I put at your disposal all my experience and knowledge for the Home Credit process, offering you personalized advice in financing for Acquisition, Construction, Construction Work, Exchange or Transfer of your Credit.

I highlight my concrete experience in Home Credit processes for Foreigners.

Priority in the personal relationship and in the expertise of the financial analysis of the business and documentation, characteristics that I consider fundamental to be able to present the best solutions.

I am at your service to support you!

What do you need?

The Credit Intermediary is the person, natural or legal, who participates in the process of granting credit:

- Present or propose credit agreements to consumers;

- Provide assistance to consumers in the preparatory acts of credit agreements, even if they have not been presented or proposed by you;

- Entering into credit agreements with consumers on behalf of the lending institutions;

- Provide consulting services by issuing personalized recommendations on credit agreements.

- The credit intermediary is not allowed to grant credit, or intervene in the marketing of other banking products or services, such as term deposits or payment services.

Advantages of using a credit intermediary?

Obtain the most adequate solution with the best conditions. By being dedicated to collecting various loan proposals for customers, the credit intermediary ends up getting better conditions and the most adequate solution for each Home Loan process.

Saving time and money. With the client no longer having to physically go to the various banks and/or financial institutions, the credit intermediary turns out to be another way to save both time and money.

Speed up the process. Since the credit intermediary is used to dealing with loan applications at banks, has privileged contacts and knows all the steps, the process becomes faster than if the client handled everything without any support.

Personalized and continuous help. All questions are easily answered by the credit intermediary, who will provide you with personalized follow-up throughout the process even after its completion.